Will Design Firms Qualify For 2022 Business Tax Deduction

Will Design Firms Qualify For 2022 Business Tax Deduction

A tax credit is a dollar-for-dollar reduction in your business tax bill because the credit is applied against your gross income. The Rules is a monthly series covering important regulations in a clear manner for architecture engineering and construction professionals. Basically you must be in business to deduct business meals. Ramifications of the PPP loan if any on Social Security payroll tax payments should be considered.

Rebate Under Section 87a Ay 2021 22 Old New Tax Regimes

As of 1 January 2022 the rates will be raised to 27 36 and 45.

Will Design Firms Qualify For 2022 Business Tax Deduction. If you are looking for an easy way to track your business meal tax deductions. The Organization Isnt Paying Federal Income Tax. However companies that receive small business loan forgiveness under the PPP may not defer their tax payments.

This has not been extended to unincorporated businesses or other structures such as LLPs. Last week the IRS issued Notice 2021-25 clarifying a provision in the Consolidated Appropriations Act that allows a 100 tax deduction of business-related food and beverage expenses provided by a restaurant in 2021 and 2022. Energy Efficient Commercial Buildings Deduction was recently extended to the end of 2020.

The previous rates were 135 27 and 36. Terms and conditions may vary and are subject to change without notice. Another useful deduction for small businesses is bonus depreciation.

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

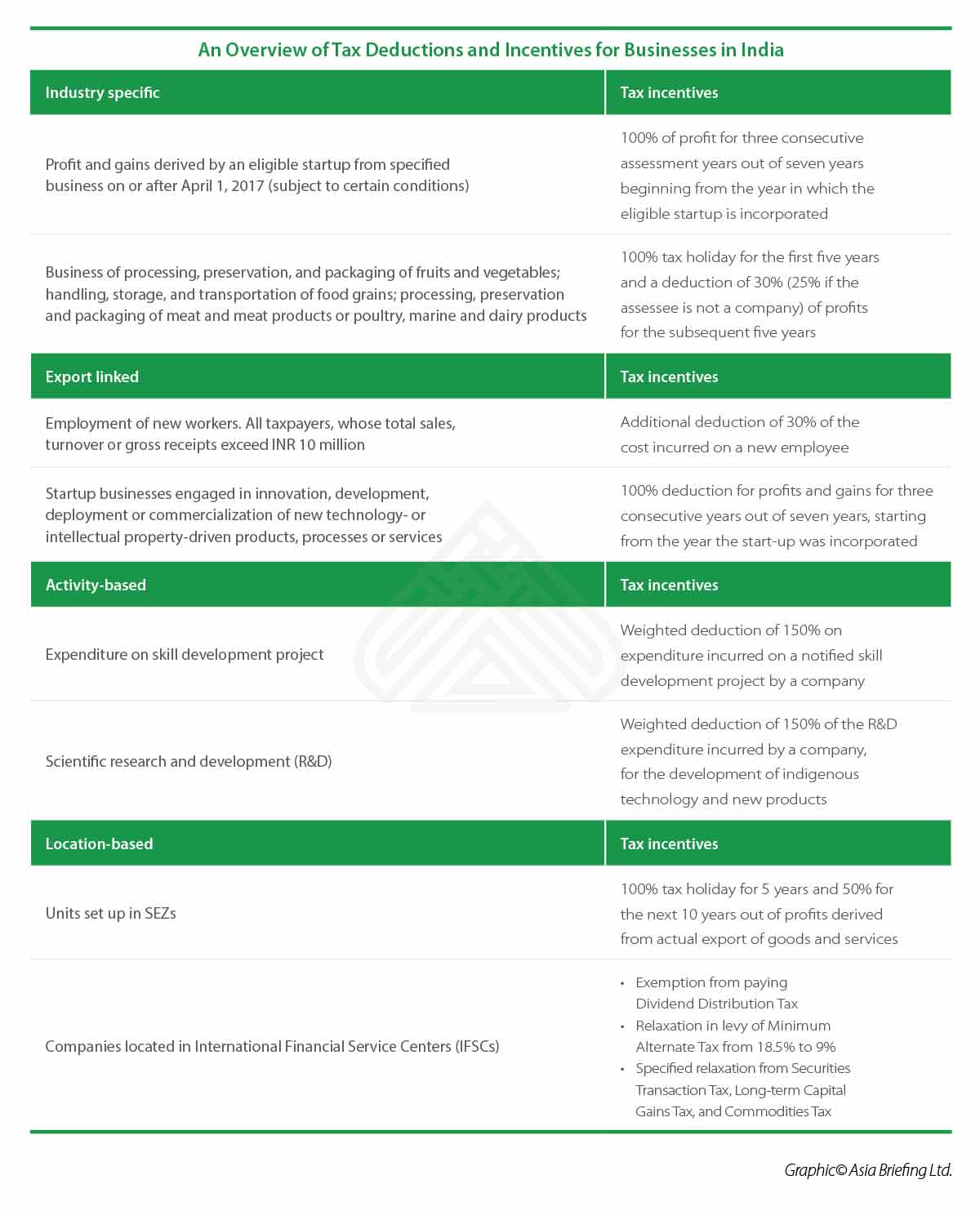

India S Tax Incentives For Business Industry And Exports India Briefing News

Tax Planning While Setting Up Of A Business For A Y 2021 2022 And A Y 2022 2023

Startups Get Tax Holiday For One More Year In Budget 2021 The Economic Times

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Tds Rate Chart For Fy 2021 2022 Ay 2022 2023

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

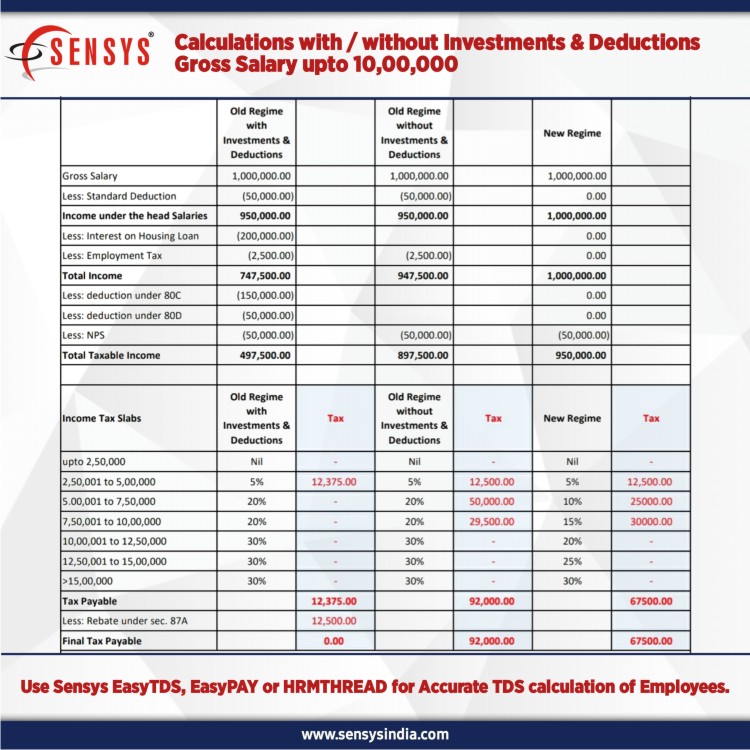

Income Tax Slabs Ay 2021 2022 Sensys Blog

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Income Tax Slabs Ay 2021 2022 Sensys Blog

Income Tax Slab Rates For Fy 2021 22 Budget 2021 Highlights

The Tax Rules For Deducting The Computer Software Costs Of Your Business Sensiba San Filippo

Small Business Tax Deduction Checklist Businessnewsdaily Com

How To Restructure Your Salary To Make It Tax Friendly Under The New Wage Code The Economic Times

Tax Slabs For Domestic Company For Ay 2021 22

Ato Depreciation Atotaxrates Info

Uk Extends 5 Hospitality Tourism Rate Till 30 Sept 2021 Then 12 5 Till 30 April 2022

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Post a Comment for "Will Design Firms Qualify For 2022 Business Tax Deduction"